What are the effects of news in trading

News trading mein khabron ka asar buhat ahem hota hai aur iska gehra asar market ke mukhtalif pehluon par hota hai. Yahan kuch ahem asarat hain jo trading mein khabron ka asar darust karte hain:

- Keemat Ki Inteha:

- Khabron ke ikhtitam ya shuru hone par asalat mein tezi aati hai. Kabhi-kabhi aise waqt hotay hain jab khabar achanak aati hai aur iska asar keemat mein tezi se izafa hota hai.

- Market Ka Jazba:

- Khabron ka asar market ke jazbay ko shakhsiyat dete hain. Positive khabar nehd aur negative khabar nafrat paida kar sakti hai. Traders aur investors apne iraday is jazbay ke mutabiq banatay hain.

- Fori Keemat Asarat:

- News ka fori asar hota hai aur market khulne par asalat mein tabdeel ho sakti hai. Kabhi-kabhi aisa hota hai ke kuch bara khabar gariyo ke asalat mein farq paida karti hai.

- Trading Volume Mein Izafa:

- Khabron ki release se trading volume mein izafa hota hai. Log naye malumat ke ishterak ke liye market mein dakhil ho saktay hain. Ye izafa likviditi mein izafa kar sakta hai lekin bid-ask spread mein bhi izafa kar sakta hai.

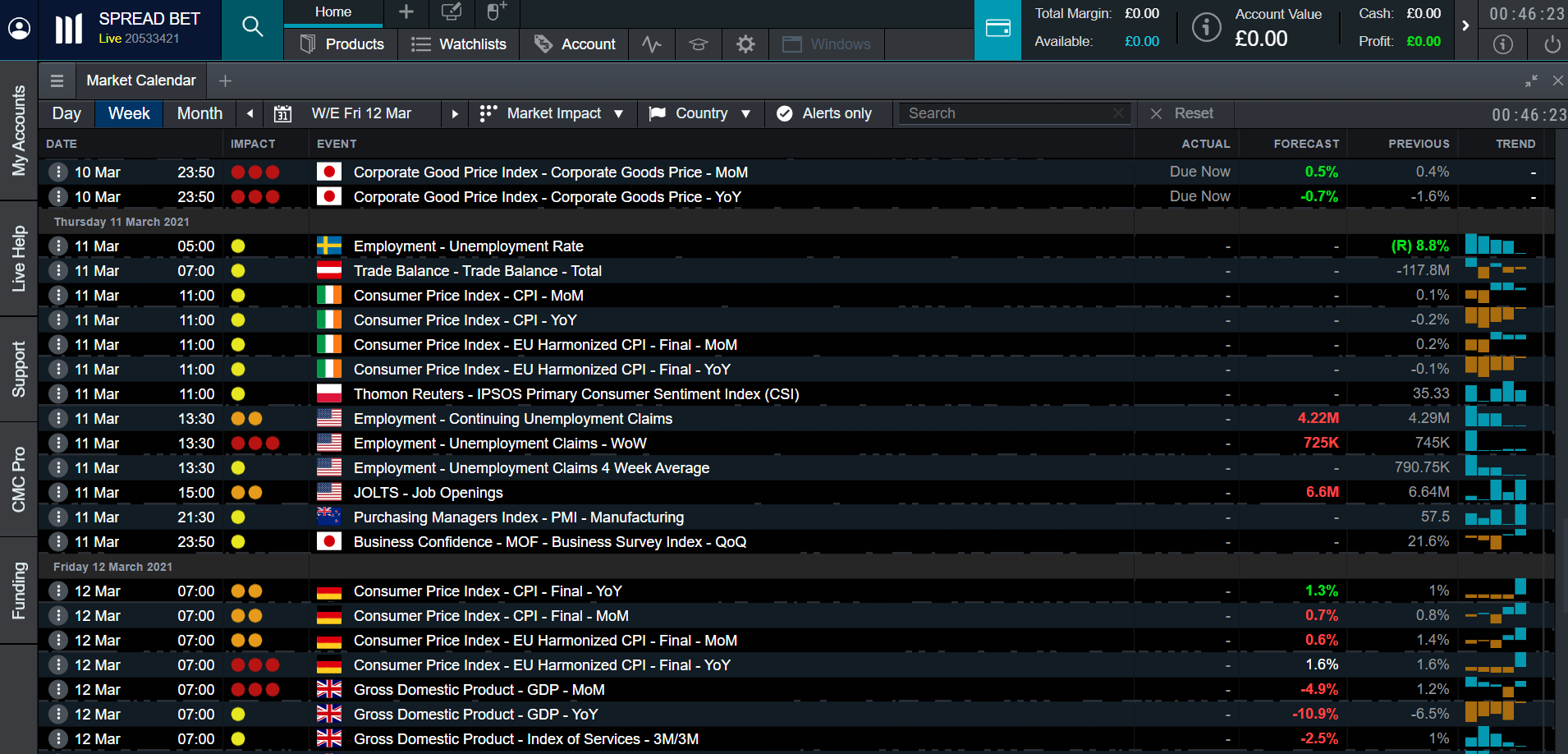

- Mali Indicators aur Central Bank Ki Karwaiyan:

- Mali indicators jaise ke rozgar ki reports, GDP figures, aur central bank ki faisle currency markets par buhat asar daal sakti hain. Traders in indicators ko mad e nazar rakhte hain taake wo samajh sakein ke mulk ki maliyat mein kis tarah ki tabdeeli aanay wali hai.

- Earnings Reports:

- Corporations ki kamai ke reports bhi stocks ke prices par asar daal sakti hain. Agar kamai achi hoti hai to stocks ke prices mein izafa hota hai, jabke nuksan ki soorat mein prices mein girawat aati hai.

- Event Risks aur Black Swan Events:

- Anjaane waqiyat, jo aksar "black swan" events kehlaye jatay hain, market par buhat gehra asar daal saktay hain. Ye waqiyat aksar pehchanay jaanay wale nahi hote aur inka asar market par ghair mamooli hota hai.

- Algorithmic Trading Reactions:

- Tanazur kiya gaya hai ke kuch market participants algorithmic trading systems istemal karte hain jo khabron ke asar par fori taur par react karte hain. Ye systems market mein tezi se tahrirat kar saktay hain.

- Safe-Haven Assets:

- Kuch khabrain, jaise ke siyasi tanazur ya iqtisadi alehdgi, investors ko safe-haven assets ki taraf raghib karna majboor kar sakti hain. Gold, U.S. dollar, aur government bonds isme shaamil hain.

- Lambi Muddat Ke Rujhan:

- Khabron ka asar lambi muddat ke trends par bhi hota hai. Maliyat, siyasat, ya riyasati halat mein asalat hone par, aset ke keemat mein tabdeelat hone ki ummid hoti hai.

Traders aur investors ko chahiye ke woh khabron se mutasir hone wale asarat ko samajhain aur market ke muqamaat ke mutabiq apne irade tay karein. Isme trading ke doran risk management ka khaas khayal rakhna bhi zaroori hai.

تبصرہ

Расширенный режим Обычный режим